PROCESS & PHASING

PRE-ACQUISITION ANALYSIS

Identify Operating Expense Anomalies

Identify Staffing Overages/Shortages

Determine Rental Trends & Reasoning

Thorough Market Comp Study & Quantify Demand

Develop Positioning Strategy

PHASE 1 - ANALYSIS & ACQUISITION

WILLIAM JAMES TRANSITION

(Month 1)

The transition team takes over day-to-day operations

Immediately address staffing opportunities

PHASE 2 - PROGRAMING & IMPLEMENTATION

PROGRAM IMPLEMENTATION

(Month 2-3)

Convert all operations functions to our platforms including Prema

Financial Solutions for all AP/AR and financial reporting functions, PayChex for all payroll, HR and benefits, and WelcomeHome CRM for sales and marketing

Initiate Changes/Business Plan

Survey residents and prospects

Sales and hospitality training

RECOVERY AND GROWTH

(Month 4-5)

Community Begins to Grow and Thrive

Culture of operational excellence created

Staff trained on new technology and company protocols

Community pride flourishes

PHASE 3 - REPORTING & MONITORING

REVIEW AND REFINEMENT

(Month 6+)

Implement Reporting & Monitoring Program

Maintain Standards of Excellence

Sales

HR

Quality Measures

Expense Control

Investment Program Overview

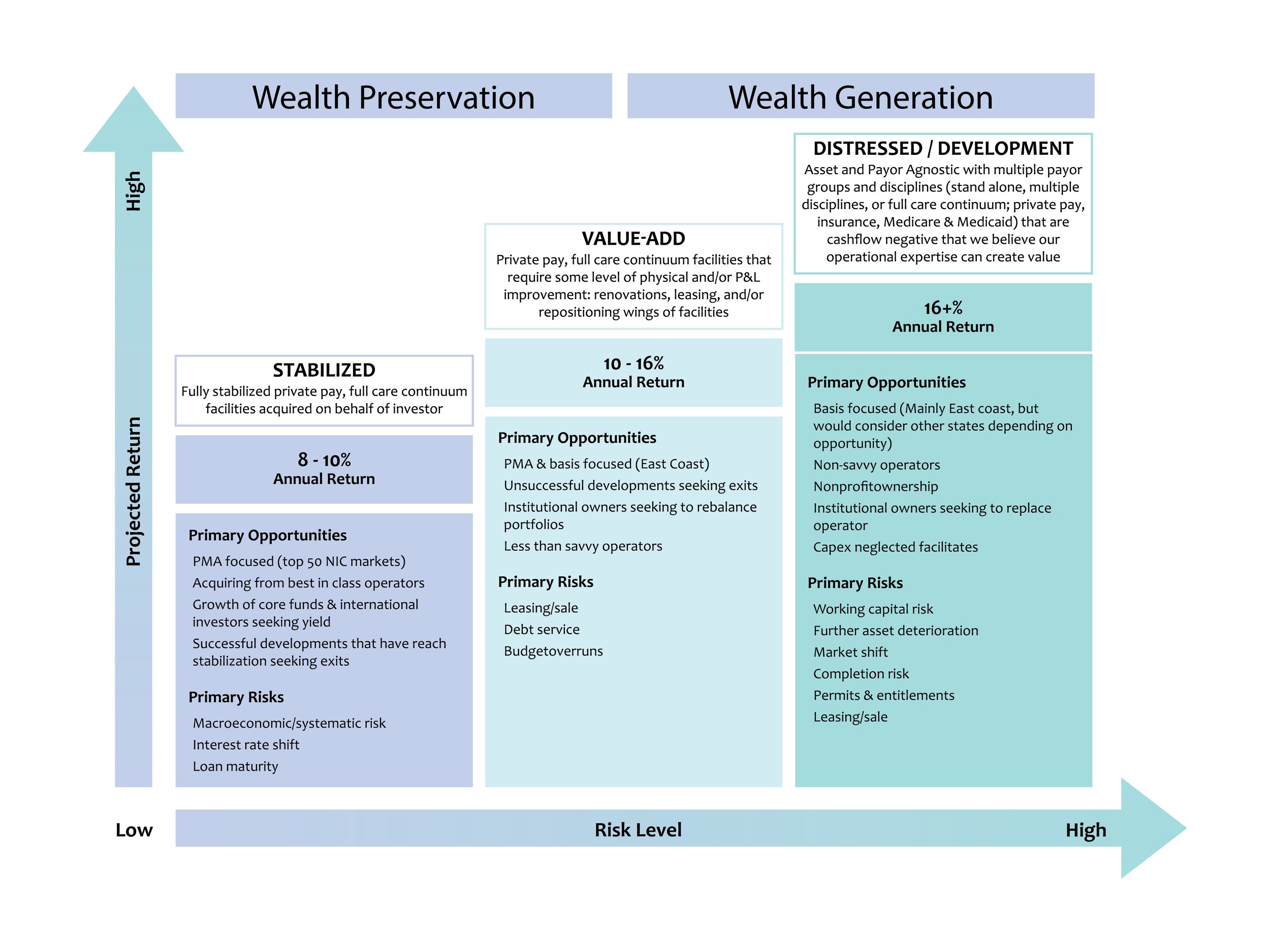

SCOPE/STRATEGY

Primary: Turnaround Value Add Investment Strategy

Secondary: Development

Tertiary: Core (Stabilized)

GEOGRAPHIC LOCATION

Alabama; Connecticut; Delaware; Washington D.C.; Florida; Georgia; Kentucky; Maryland; South Carolina; New Jersey; New York; North Carolina; Pennsylvania; Tennessee; Virginia; West Virginia

PRODUCT TYPE & VINTAGE

Core (Stabilized): CCRC & IL/AL/MC & AL/MC; 2013+ Vintage

Value Add: CCRC & IL/AL/MC & AL/MC; 2000+ Vintage

Turnaround: CCRC IL/AL/MC AL/MC; 1990+ Vintage

DEMOGRAPHIC REQUIREMENTS

Core (Stabilized) & Development:

Adult Children minimum income of $120K

Seniors Affordability Ratio: 3x

Adult Children to Seniors Ratio: 5x

Value Add:

Adult Children minimum income of $100k

Seniors Affordability Ratio: 2.5x

Adult Children to Seniors Ratio: 4x

Turnaround:

Adult Children minimum income of $80k

Seniors Affordability Ratio: 2.5x

Adult Children to Seniors Ratio: 3x

HOLD PERIOD

Turnaround & Value Add: 3-5 Years

Development: 5-7 Years

Core (Stabilized): 7+ years (Long Term)

TARGET IRR RETURNS

Core (Stabilized): 8-10% IRR

Value Add: 11-15% IRR

Turnaround Development: 15%+ IRR

STANDARDS OF EXCELLENCE

Sales and Marketing

Sales and Marketing Plan in place for all communities, including:

Onsite sales assessment

Sales training

Ongoing sales support

Monthly scoreboard to reflect gains toward goals

This plan includes monthly goals for contracts and other analytics in CRM

CRM - WelcomeHome

Tracks leads, tours, advances, contracts, conversion rates, TSZ

Monitor through analytics in the CRM

ED’s complete audit tool weekly to identify areas for improvement

Provide monthly score boarding

Quality Measures

Call bell response time reports (daily and weekly)

ADL completion report (weekly)

QI/QM

Mock survey results (as completed)

Community Scoreboard (monthly)

Work Order response time report (weekly)

Expense Control

Partnership with Prema Financial Solutions for AR/AP, Reporting and controls

FTE & Wage Report (each pay period)

Departmental Spend Down (reviewed weekly)

OT and Agency report (twice a week)

Monthly BvA /Operations report

Human Resources

Open Position report (weekly)

Quarterly wage study (Payscale.com)

FTE report to validate needs

Turnover/Retention report (monthly rolling 12)

PayChex - scheduling software

PayChex - online training/in-services